Gold is the New Dot-Com

History has a funny way of repeating itself. In the mid- to late-1990s, was we saw the Dot-com Bubble with internet companies with stock valuations that simply could not be justified by their fundamentals. I believe that we are seeing the same thing today with gold prices.

It's 1999 all over again. Gold is the new dot com.

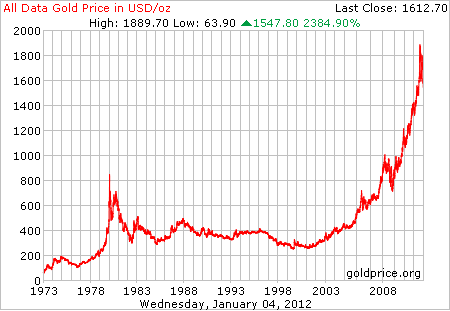

From 1973 - 2005, gold traded in the $200 - $300 price range on a fairly consistent basis. In 2005, it began its surge upwards, with the real momentum beginning in 2009.

Gold is currently trading at more than $1,600 per ounce, which is roughly 4.5 times its historic norms. Things are far from ideal in our economy or political sphere. However, there is simply no economic rationale for gold any higher than $700 - and even $700 per ounce is pushing it, in my opinion.

I'm not ready to start shorting gold yet. I believe it will likely stay in the $1,600 - $1,700 price range for the next few months as various problems work themselves out, most notably Europe's debt crisis. However, I believe that gold is headed for a major correction in months ahead.

And when one looks at far this has to drop, I believe it's going to be a painful drop for a lot of people.

It's 1999 all over again. Gold is the new dot com.

Comments